The International Monetary Fund has revealed that Nigeria is not among Africa’s fastest-growing economies, as countries such as Benin Republic, Côte d’Ivoire, Ethiopia, Rwanda, and Uganda continue to lead the continent’s growth trajectory in the world.

The IMF said the five countries are now among the world’s fastest-expanding economies, buoyed by sustained policy reforms, improved fiscal management, and investments in infrastructure and manufacturing.

The Director of the IMF’s African Department, Abebe Selassie, disclosed this during the launch of Sub-Saharan Africa’s latest Regional Economic Outlook at a press briefing monitored by our correspondent on Thursday.

He said Benin, Côte d’Ivoire, Ethiopia, Rwanda, and Uganda are among the world’s top-performing economies, crediting their strong growth to fiscal reforms and macroeconomic stability.

The Director also noted that overall growth in Sub-Saharan Africa is projected to stabilise at 4.1 per cent in 2025, with a modest pick-up expected in 2026, powered by macro stabilisation and reform efforts in key economies.

Selassie said, “Six months ago, our assessment highlighted the region’s strong efforts and that growth had exceeded expectations last year. But we also noted sudden realignment of global priorities and increasing turbulent external conditions, marked by weaker demand, softer commodity prices and tighter financial markets. Today, these global headwinds continue to test the region’s recovery and resilience.

“Sub-Saharan Africa’s economic growth, we now estimate, is expected to hold steady at 4.1% this year, with a modest pick-up expected in 2026. In our view, this reflects ongoing progress in macroeconomic stabilisation and reform efforts across the major economies in the region.

“It is important to note that several countries in the region, Benin, Côte d’Ivoire, Ethiopia, Rwanda, Uganda, are among the fastest-growing economies in the world.”

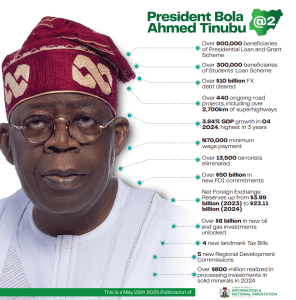

This omission comes despite the IMF’s recent upward revision of Nigeria’s growth forecast, projecting the economy to expand by 3.9 per cent in 2025, driven by higher oil output, improved investor confidence, and a more supportive fiscal policy.

The updated figures reflect a 0.5 percentage point increase from its previous forecast and signal renewed optimism about the country’s medium-term economic prospects.

In July, the IMF revised Nigeria’s economic growth projection for 2025 upward to 3.4 per cent, a 0.4 percentage point increase from the 3.0 per cent forecast published in its April 2025 World Economic Outlook.

The National Bureau of Statistics also reported last month that Gross Domestic Product grew by 4.23 per cent year-on-year in real terms in the second quarter of 2025.

The figure marks a notable improvement from the 3.48 per cent growth recorded in the corresponding period of 2024, reflecting modest gains from increased oil output, recovery in key non-oil sectors, and easing inflationary pressures.

However, the IMF’s verdict indicates that the growth remains below potential, and the government is urged to deepen structural reforms, improve electricity supply, curb inflation, and expand non-oil revenue through industrial diversification and better tax administration

“We still have quite a few resource-intensive countries and conflict-infected countries continuing to face significant challenges with only modest gains in per capita incomes. The external environment remains challenging, global growth is slowing, and commodity prices are diverging. Notably, oil prices are declining, while the price of copper, coffee and gold are fairly elevated.”

The fund also raised concern over rising financial vulnerabilities in Nigeria and other Sub-Saharan African countries, warning that governments’ growing dependence on domestic bank borrowing poses increasing risks to financial stability.

Selassie revealed that many governments are forced to turn to domestic banks as external financing dries up, deepening the “sovereign-bank nexus.” In about half of the cases, the IMF estimates that public debt is now held by domestic financial institutions, a trend that heightens risks to banking sector stability.

He explained that as access to external financing tightens, several African governments have turned to domestic lenders to sustain public spending, a trend he described as a double-edged sword that could strain banks’ balance sheets and deepen the link between public debt and financial sector risks.

“It has been really good to see the region showing strong resilience. But this will continue to be tested in the coming months. Pressure points include rising debt service costs, which are crowding out development spending, a shift towards domestic financing that has deepened the sovereign bank nexus, inflation that has eased at the regional level but remains in double digits in quite a few countries in the region, and external buffers that are under pressure and need to be rebuilt.

“Against this backdrop, we see two broad policy priorities. The first is domestic revenue mobilisation. This is very important to increase our country’s potential, the significant potential to be tapped here also, and the reforms that need to be considered here include modernising tax systems through digitalisation, streamlining inefficient tax expenditures, and strengthening enforcement via targeted compliance strategies.

“And importantly, these efforts must go beyond technical adjustments. It will be essential to build public trust in tax institutions, strengthen institutional capacity, and conduct careful impact assessment, including distributional analysis, to ensure that these reforms are both effective and equitable.

“The IMF, of course, remains committed to supporting the region. Since 2020, we have disbursed nearly $69bn, including about $4bn so far this year. Our capacity development efforts also remain substantial, with countries in the region amongst the largest recipients of technical assistance.”

Selassie warned that in countries with high debt levels and elevated interest rates, stress could spill over into banks’ balance sheets. He called on governments to strengthen regulatory oversight, capital buffers, and ensure that public finance trajectories reduce the likelihood of harmful spillover over the years.

“On the issue of domestic banks’ vulnerabilities to rising public debt levels. So again, this is a point that we’ve been highlighting for several years. At this moment, we estimate that about half of the total public debt is held by domestic institutions. This has gone up over the years. As always, it’s a double-edged sword. As access to external financing has declined over the years, our countries, our governments have been able to turn to domestic banks, have had to turn to domestic financial institutions to sustain spending levels, to sustain economies.

“That has been a source of resilience, but we are now seeing a situation where there are significant vulnerabilities, and in particular in those countries where public debt is at very elevated levels, the risk of distress is higher, we are seeing some pressures on bank balance sheets, or there could be potential pressures on bank balance sheets.

“So again, it varies from country to country, the extent to which there are vulnerabilities, but it is an area of some concern in those countries where public debt is high, where interest rates are high, and we’re working with governments to make sure that there is a robust regulatory framework, robust capitalisation plans for banks, and of course first and foremost, the first line of defence, making sure that public finances are in a healthy trajectory to ensure that their spillovers are limited,” the director explained.

He added that Inflation remains stubborn in several countries, even as the regional average eases. And external buffers, such as foreign reserves, are under stress and in urgent need of replenishment.

Selassie warned that the region’s recovery is under pressure from external turbulence, weaker global demand, volatile commodity prices, and tighter global financial conditions.

He cited declining oil prices even as metals like copper, coffee, and gold remain elevated.

While a few countries, such as Kenya and Angola, have regained access to international capital markets, the IMF cautioned that tariff increases from the U.S. and the expiry of preferential trade access under AGOA erode growth prospects.

The impending sharp decline in foreign aid further constrains low-income and fragile states, limiting their fiscal flexibility.

To reinforce resilience, the IMF laid out two broad policy priorities, “Domestic revenue mobilisation, via modernising tax systems (especially through digitalisation), pruning inefficient tax expenditures, and reinforcing compliance.”

But Selassie emphasised that such reforms must also build public trust, institutional capacity, and include distributional impact assessments.

He said, “Debt management; increasing transparency, reinforcing public financial management, publishing comprehensive debt data, and improving budget oversight. These measures, he argued, will help reduce borrowing costs and unlock innovative financing options.”

Turning his attention to Nigeria, the IMF analyst noted that the decline in inflation is consistent with ongoing monetary tightening and a more flexible exchange rate regime. But he warned that inflation remains sticky due to a “level shift”, meaning prices have settled at higher levels. He urged continued policy discipline to hit targets.

“So starting with inflation in Nigeria, we find the decline in inflation consistent with the tightening of policies that have been undertaken in recent years, particularly on the monetary policy front, but also the effect of the exchange rate adjustment that took place over the last year or so and more, having come through the system. So it is consistent with the policy calibration and we are encouraged by it, but I think there are still some ways to go, towards the government’s target.

“Public debt is high, of course, in many countries in the region. Right now we estimate about 20 countries to be in a situation of high risk of debt distress. This comprises about 14 countries at high risk of debt distress and another six in actual debt distress.”

The IMF stressed that boosting growth is key to making debt servicing affordable, and that not all nations face identical challenges, hence the need for tailored policy frameworks.

Selassie also spotlighted illicit financial flows, urging countries to identify leakages (trade mis-invoicing, capital outflows, tax evasion) and adopt reforms targeting their root causes.

“Lastly, on illicit financial flows, I think, you know, this is the nature of, you know, what comprises things that we consider illicit financial flows vary. Some of it is just simple trade, you know, leakages to do with capital outflows.

“Others have related to, you know, people trying to circumvent the tax system. Still others are completely illegal flows, you know, related to corruption or other flows. So I think, you know, the way to tackle this is to identify what the source of the particular flows is and tackle them through reforms.

“So, again, a lot of the reforms, the direction of reforms that countries are pursuing should go in a way to help address many of these challenges that we are seeing in terms of illicit financial flows.”

Finally, he warned that while market access is improving, borrowing conditions remain expensive. Governments should treat costly external borrowing cautiously and always anchor decisions on a sound medium-term fiscal path.

Despite these warning signs, the IMF commended the region’s resilience and ongoing reform efforts, saying that progress in fiscal consolidation, exchange rate flexibility, and monetary tightening in major economies like Nigeria has helped stabilise growth and ease inflationary pressures.

“On the challenges related to policy in the U.S., I mean, first thing to note is that the fallout from the higher tariffs that have been imposed in the U.S. has not been as bad as we had feared back in April. So the global economy has weathered.

“And importantly, we have not seen other countries, you know, going in the same vein of raising tariffs. So that’s encouraging. Second, you know, this said, countries that are exporting to the U.S. and that are relying on significant exports to the U.S. and they are limited, will be facing higher barriers to trading to the U.S. So, some thinking about, you know, how to reorient these flows, finding different ways to address this challenge will be needed in those countries.

“One of the striking things about African trade is that when we trade with each other, increasingly we tend to trade in more manufactured goods, higher value-added goods. When we trade with the rest of the world, we are exporting natural resources. So there’s actually a big plus in terms of trading with each other, and there’s a big benefit to be had from promoting intra-Africa trade, so I think this is also an opportunity to work in those kinds of areas,” he concluded.

Meanwhile, the International Monetary Fund has commended Nigeria’s ongoing fiscal and monetary policy reforms, describing the country’s policy direction as “broadly positive” amid signs of easing inflation and improving foreign exchange transparency.

Officials of the IMF’s Fiscal Affairs Department and Monetary and Capital Markets Department made the remarks during the presentation of the Fiscal Monitor and Global Financial Stability Report on the sidelines of the 2025 IMF/World Bank Annual Meetings in Washington, DC.

The IMF said Nigeria’s fiscal stance is currently neutral, meaning that government spending and taxation are balanced in a way that supports monetary efforts to tame inflation without stifling growth.

“Currently what we are projecting for Nigeria is a neutral fiscal stance,” said Davide Furceri, Division Chief at the IMF’s Fiscal Affairs Department. “We think that this neutral fiscal policy stance is also consistent in helping monetary policies to reduce inflation.”

Furceri praised the Nigerian government’s reforms in recent years, especially in tax administration and expenditure efficiency, noting that such efforts have helped to simplify the tax code, reduce burdens on businesses, and cut wasteful spending.

“Nigeria has done quite a lot in the past years,” he added. “Many of the laws that have been passed have tried to streamline tax codes, reduce tax expenditures, and ease the burden on businesses and low-income households. These are policies that go in the right direction.”

He explained that beyond revenue mobilisation, Nigeria could achieve faster economic gains by improving the efficiency and composition of public spending, especially by channelling more funds into social protection to reduce vulnerability among low-income groups.

Presenting the Global Financial Stability Report, the IMF’s Director of Monetary and Capital Markets, Tobias Adrian, said Nigeria’s recent exchange rate adjustments and tighter monetary policy had improved policy credibility and strengthened external buffers.

“Exchange rates are important buffers to adjust the domestic economy relative to shocks,” Adrian said. “A depreciating exchange rate is not necessarily a bad thing; it may actually be a good thing to restore equilibrium. We have indeed seen in Nigeria many steps to strengthen policy frameworks, such as on the monetary policy side.”

He added that the IMF generally supports more flexible exchange rates for economies like Nigeria’s, noting that such flexibility helps cushion the impact of external shocks and restore balance in the foreign exchange market.

Supporting this position, Assistant Director at the IMF, Jason Wu, said Nigeria’s economic trajectory had improved significantly over the past year, helped by higher revenues and stronger FX reserve management.

“Revenue collection has strengthened in Nigeria and transparency in terms of FX reserve positions has improved,” Wu said. “All of this has contributed to lower inflation, from more than 30 per cent last year to 23 per cent this year, as well as improved FX reserve positions. So the direction of travel appears to be positive.”

The IMF, however, warned that despite these positive developments, Sub-Saharan Africa continues to face external headwinds, including the risk of another round of capital flow volatility that could affect economies with weak fundamentals.

“While growth has been pretty strong and capital flows are resuming, the previous surge-and-retrenchment cycles could happen again,” Wu warned. “When that happens, it could expose some of these economies to vulnerabilities, particularly when foreign investments retrace.”

He urged African countries to consolidate fiscal discipline, strengthen debt management, and deepen structural reforms to reduce vulnerability to external shocks.

“It is important for countries to continue to improve fundamentals on the fiscal and monetary policy side, but also in terms of developing more structural policies, like revenue mobilisation, debt management and hopefully also support from the international community,” Wu added.