The fresh developments surrounding Nigeria’s proposed $5 billion oil-backed loan deal with Saudi Aramco highlight the dangers of the country’s persistent dependence on oil.

Reports indicate that the deal has been stalled due to falling oil prices, fresh market uncertainties, and scepticism about Nigeria’s ability to meet its crude production targets. Banks are wary of supporting the arrangement due to these concerns.

Though the Federal Government insists that no final decision has been made and urges the public to disregard speculation, the very consideration of such a loan exposes the country’s fiscal myopia.

Brent crude prices have dropped 20 per cent since January 2025 to $65 per barrel, while oil production has slumped to 1.5 million barrels per day, well below the 2m bpd assumed in the national budget. This situation lays bare the risks of oil-centric budgeting and borrowing.

This crisis is a recurring symptom of Nigeria’s failure to diversify an economy where oil still accounts for 90 per cent of export earnings and 60 per cent of government revenue.

With shrinking fiscal buffers, rising debt, and a population increasingly impoverished by policymakers’ inability to escape the “resource curse,” Nigeria faces a reckoning for decades of poor choices.

Oil dependency has created a self-reinforcing cycle of instability. The proposed Aramco loan, backed by 100,000 bpd of crude, would have raised the daily oil committed to debt servicing to 400,000 barrels, about a quarter of current output.

Tying more debt to oil production is poor economics, especially given global market uncertainties. Lower prices mean more oil must be diverted to repay loans, starving the treasury of vital revenue.

Since 2019, forward crude sales by the NNPC have reached $21.5 billion, making it nearly impossible for the company to meet its domestic crude supply obligations to local refiners. Some of these loans are due for repayment as far off as 2034. In the first two months of 2024 alone, Nigeria’s crude-backed loans cost the country about $1.4 billion from 17 million barrels of oil.

Economic modelling underscores the structural risks of this approach. A 2023 study found that every 10 per cent swing in oil prices reduces Nigeria’s GDP growth by 0.3 per cent, even as it temporarily inflates government revenues, creating a perverse incentive to double down on oil-backed borrowing.

Nigeria’s predicament is rooted in decades of pervasive corruption and mismanagement. The oil sector has suffered from underinvestment, ageing infrastructure, rampant theft, operational inefficiencies, and systemic leakages.

Between 2009 and 2020, Nigeria lost 619.7 million barrels of crude oil, worth about $46.16 billion, to theft. In 2016 alone, 15.3 per cent of production was lost, valued at N1.16 trillion.

A leaked 2012 report revealed that Nigeria lost $29 billion in the previous decade to a natural gas price-fixing scam. In 2022, an audit found that the NNPC failed to remit $4.6 billion in crude oil sales over four years.

A former EFCC chairman revealed that Nigeria lost $450 million to fuel subsidy fraud between 2006 and 2012.

Unlike other oil-rich nations, Nigeria has little to show for its oil wealth. Revenues have not translated into adequate infrastructure, healthcare, education, or fiscal savings.

For comparison, Norway, whose oil discovery came 11 years after Nigeria’s, has built a $1.8 trillion sovereign wealth fund, with a three per cent annual withdrawal limit to preserve wealth for future generations.

Nigeria’s sovereign wealth fund, by contrast, is valued at just $2.95 billion, and its excess crude account, which had a balance of over $20 billion in 2008, now holds less than $500,000.

To avoid further embarrassment over its perceived ability to repay loans, Nigeria must build a resilient, diversified economy.

The country should harness the transformative potential of its agricultural sector, once Africa’s largest exporter.

With 84 million hectares of arable land (40 million unused) and a 70-million-strong agrarian workforce, Nigeria could revive cash crops like cocoa, cashew, cotton, and oil palm. Global demand for cassava and its derivatives could generate $5 billion annually by 2030 with improved processing infrastructure.

With 21 million cattle, Nigeria could become a major producer of beef and dairy products if it adopts modern practices and technology. The Netherlands, with just 3.7 million cattle, generated $10 billion from milk in 2023, while Brazil’s beef industry was worth $262.3 billion, with $12.8 billion in exports in 2024. Brazil’s $2.5 billion investment in Nigeria’s meat industry through JBS could be transformative.

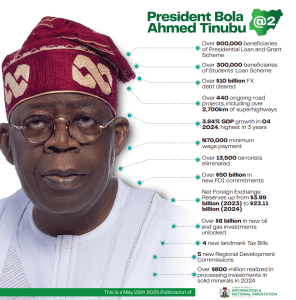

Tinubu’s promise of 2,000 new tractors, 1,000 of which have reportedly arrived, could boost farm mechanisation, a key deficit that has hampered yields and efficiency. These tractors must be quickly deployed to farms.

Digital platforms like Farmcrowdy and Thrive Agric are already linking two million smallholder farmers to markets and financing; such innovations should be scaled up, alongside improvements in fertiliser availability and security.

Nigeria sits atop $700 billion in solid mineral reserves, including gold, lithium, and rare earths, yet these contribute just 0.5 per cent to GDP. Strategic reforms could unlock this sector’s potential.

The government aims to attract $500 million in mining investments by 2026, but only three per cent of minerals are processed locally. Chinese-backed lithium processing plants in Kebbi and Nasarawa highlight the sector’s immense potential.

The marine and blue economy offers an ocean of opportunities. The government targets $150 billion in maritime sector contributions by 2030, and boosting aquaculture could produce 2.5 million metric tonnes of fish annually, reducing the $1.2 billion import bill.

Offshore wind and tidal energy projects could supply 1,000 MW of clean power, while developing coastal resorts and cruise lines along Nigeria’s 850km coastline could significantly boost tourism earnings. The sector is projected to reach $3.77 billion in revenue by 2025 and $5.64 billion by 2029. Success will require sound strategies and clinical execution.

Diversification must also embrace IT and digital services. Nigeria’s tech sector, growing at 12.5 per cent annually, is poised to become a $75 billion industry by the end of the year, driven by an e-commerce boom. The country has already produced five of Africa’s nine unicorns as of 2024.

Crucially, manufacturing must be revamped through reforms that improve the ease of doing business and address challenges such as exchange rate instability, high inflation, poor access to credit, high interest rates, energy and logistics costs, multiple taxation, and a hostile regulatory environment.

Human capital deficits must be addressed through STEM education and vocational training to supply the workforce needed for non-oil sector entities well into the future. China transformed into a global economic, manufacturing, tech, and military powerhouse largely due to investments in quality education.

While Tinubu has reiterated his administration’s commitment to market-driven growth and improved economic indices, true diversification cannot occur without tackling systemic corruption.

Nigeria must implement transparency mechanisms for resource revenues, including public audits of NNPC accounts, and prioritise investment in power, security, roads, railways, and education.

The proposed tax reforms, if properly implemented, will foster efficiency, voluntary compliance, fairness, cut leakages in the system, and move tax contributions to 18 per cent of GDP, up from 13.5 per cent currently.

With the global shift toward green energy and renewables, continued reliance on oil is unsustainable. The Aramco loan debacle is a wake-up call. Nigeria’s 37 billion barrels of oil reserves are finite.

Malaysia and Saudi Arabia have used oil revenues to build diversified economies and invest in tourism and renewables.

The UAE has transformed into a real estate investment haven and global financial hub, using oil sales.

Nigeria cannot remain a petro-state trapped in boom-bust cycles. It must leverage its vast human and natural resources to build a resilient, multi-sector economy.