The Central Bank of Nigeria has barred states benefitting from bailout package from using part of the funds to pay contractors for any infrastructure project.

The restriction on payment to contractors, it was learnt on Monday, was part of the conditions attached by the central bank for the release of the bailout funds.

This came just as economists were divided over the possible effect of the N338bn bailout fund on the economy. While some expressed the belief that the fund would increase economic activities, others said the level of decline the economy had witnessed was larger than what the intervention fund could remedy.

A top official in the central bank confided in one of our correspondents on Monday that the CBN had mandated banks to ensure that the loans were only released for the payment of outstanding workers’ salaries.

The official said, “There are many conditions attached to the issuance of this loan and one of them is that no contractor or any other person who does not have outstanding salaries would be paid from the bailout package.

“So, the banks will not pay contractors or any other person that is not on the government’s staff payroll.”

The CBN had last Wednesday given approval to the request by Deposit Money Banks to provide funds to state governments to enable them to pay the backlog of salaries of their workers.

The Director, Corporate Communications, CBN, Mr. Mu’azu Ibrahim, had stated that the approval was based on the CBN’s decision to collaborate with relevant stakeholders to consider ways of liquidating the outstanding staff salaries owed by state and local governments.

Other conditions for accessing the loans are a resolution of the State Executive Council authorising the borrowing and state House of Assembly consenting to the loan package be passed.

In addition, there is a need for the issuance of Irrevocable Standing Payment Order to ensure timely repayment of the loan.

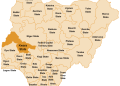

Out of the 27 states involved, funds have been disbursed to two states, namely: Zamfara and Kwara, that met the requirements as agreed with their respective banks.

The release followed the restructuring of their debts into bonds by the Debt Management Office at an interest rate of 14.83 per cent of the value, which their debts to commercial banks were converted into.

The Director-General, DMO, Dr. Abraham Nwankwo, had stated in Abuja that the 14.83 per cent would be paid by the 11 states whose debts had already been restructured in the first phase of the exercise.

The restructuring, according to him, has already been effected, noting that with the arrangement, the bond already issued would mature on July 18, 2034.

The first 11 states that got their debts to commercial banks restructured are Osun, N88.6bn; Delta, N69.8bn; Ogun, N55.4bn; Imo, N37.1bn; Ekiti, N18.8bn; Kwara, N15.6bn; and Edo, N11.9bn.

Others are Benue, N10.9bn; Oyo, N9.1bn; Bauchi, N6.5bn and Kogi, N0.81bn.

Nwankwo said, “The debt restructuring operation and their total loans to the 11 states, which were restructured, amounted to N322.78bn. The restructuring was effected using a re-opening of the FGN-Bond issued on July 18, 2014 and maturing on July 18, 2034. The pricing was based on the yield to date of the bond at a 30-day average, resulting in a transaction yield of 14.83 per cent.”

He explained that the debt restructuring exercise was open to all the 36 states of the federation and the Federal Capital Territory, but added that the second phase of the commercial debt-restructuring exercise would commence when the remaining 11 states must have completed the reconciliation of their loans with their respective banks.

Meanwhile, an economic analyst and Head of Portfolio Management at Meristem Wealth Management Limited, Mr. Taiwo Yusuf, reacting to the development, said a huge chunk of the N338bn would be used to pay salaries, which falls under recurrent expenditure.

He noted that the N338bn would go into the economy without any major stimulation in economic activities because the multiplier effect of the payment of salaries might not lead to a significant revamp in economic activities.

Aligning with this perspective, an economist and Chief Executive Officer, Investments Upgrades, Mr. Chinedu Nwankwo, said the N338bn might increase the purchasing power of the affected workers and lead to increase in consumption, but it might not necessarily lead to any increase in production activities soon.

But the Head, Research and Investment, Afrinvest West Africa Limited, a research and investment advisory firm, Mr. Ayodeji Ebo, said the payment of the N338bn to workers would lead to an increase in economic activities and the purchasing power of the workers as well as the production of more consumer goods. Agency report