The Central Bank of Nigeria (CBN) on Monday stated that the drop in the value of the naira to the dollar had weakened the capital of banks.

The CBN Governor, Mr Godwin Emefiele, disclosed this on Monday Abuja during the unveiling of his economic agenda for the next five years,

The depreciation of the naira between 2004 when the last banking sector recapitalisation took place and now has cut the value of the capital of each Deposit Money Bank (DMB )by about $175m.

The recapitalisation of the banking sector, which was done in 2005, required the banks to raise their capital base from N2bn to N25bn.

The exercise then saw the emergence of 24 Deposit Money Banks following the merger of some of them as well as the acquisition of many that could not raise the required capital.

However, due to the drop in the value of the nation’s currency which now exchanges for N360 to a dollar, the CBN governor put the translated value of N25bn at just about $75m.

Going by this, it, therefore, means that the value of the capital of each bank had been reduced by $175m.

Based on the number of Deposit Money Banks in the country which stands at 20, the total value of the capital base may have been eroded by about $3.5bn.

Emefiele said going by the huge developmental role the apex bank would want the banks to play in the next five years, it had become imperative to demand their recapitalisation.

Following the announcement of the recapitalisation exercise, Emefiele said the Committee of Governors of the CBN would meet to discuss the new policy.

The meeting is expected to discuss modalities for the recapitalisation exercise as well as approve the framework that would guide the implementation of the policy.

The CBN governor said during the unveiling of his agenda for the next five years that the recapitalisation of banks had become imperative as their current capital could no longer finance large transactions.

He said, “In the next five years, we intend to pursue a programme of recapitalising the banking industry so as to position Nigerian banks among the top 500 in the world.

“Banks will, therefore, be required to maintain a higher level of capital, as well as liquid assets in order to reduce the impact of an economic crisis on the financial system.

“Recall that it was Governor (Chukwuma) Soludo in 2004 that did the last recapitalisation we had. He moved the capitalisation from N2bn to N25bn. And I must commend those efforts because it resulted in positioning Nigerian banks not only in Africa but among the top banks in the world in terms of capitalisation.

“It also helps to increase the banking industry’s capacity to take on large transactions. And those are some of the things we badly need today.

“So if you relate N25bn with 2004 exchange rate which was about N100 (to a dollar), N25bn was about $250m. Today, if you relate N25bn at N360 (to a dollar) you will see that it is substantially lower than $75m.

“So what we are trying to say is that the recapitalisation has weakened and there is a need for us to say it is time to recapitalise the banks again.

“It’s a policy thrust which would be discussed at the committee of governors’ meeting and of course, the framework for the recapitalisation of Nigerian banks would be unfolded for the whole world in due course.”

Providing more insights on his economic agenda which centred on five major priorities, the CBN governor said he would work closely with the fiscal authorities to achieve double-digit growth rate within the next five years.

He said during his second term in office, his first priority would be to ensure domestic macroeconomic and financial stability.

This, he said, would be followed by the need to foster the development of a robust payment system infrastructure that would increase access to finance for all Nigerians thereby raising the financial inclusion rate in the country.

The governor said his third priority would be to continue to work with Deposit Money Banks to improve access to credit for not only smallholder farmers and Micro, Small and Medium Enterprises, but also consumer credit and mortgage facilities for bank customers.

Emefiele said the CBN’s intervention support would also be extended to the youth population who possessed entrepreneurship skills in the creative industry.

During this intervention period, the apex bank boss said the CBN would encourage Deposit Money Banks to focus more on supporting the education sector.

On his fourth priority, he said the focus here would be to grow the country’s external reserves, adding that his fifth priority would be to support efforts at diversifying the economy through the CBN’s intervention programmes in the agriculture and manufacturing sectors.

“We are confident that when implemented, these measures will help to insulate our economy from potential shocks in the global economy.

“In my second term in office, part of my pledge is to work to the best of my abilities in fulfilling these objectives,” he added.

Speaking on strategies to achieving these priorities, Emefiele said the CBN would implement its agenda under various initiatives.

This, he noted, would enable the bank to achieve macroeconomic stability, exchange rate stability, financial system stability, financial inclusion, access to credit, lending to MSMEs, consumer credit and mortgage lending among others.

Macroeconomic stability

In the area of macroeconomic stability, the CBN governor said, “We intend to leverage monetary policy tools in supporting a low inflation environment while seeking to maintain stability in our exchange rate.

“As a result, decisions by the Monetary Policy Committee on inflation and interest rates will be dependent on insights generated from data on key economic variables.”

Working with other stakeholders, he said the bank intended to bring down the cost of food items, which had considerable weight in the Consumer Price Index basket.

He said, “Our ultimate objective is to anchor the public’s inflation expectation at single digit in the medium to long run.

“We believe a low and stable inflationary environment is essential to the growth of our economy because it will help support long term planning by individuals and businesses.

“It will also help to lower interest rates charged by banks to businesses thereby facilitating improved access to credit, and a corresponding growth in output and employment.”

Exchange rate stability

In achieving exchange rate stability, Emefiele said the apex bank would continue to operate a managed float exchange rate regime in order to reduce the impact which continuous volatility in the exchange rate could have on the economy.

He said, “We will support measures that will increase and diversify Nigeria’s exports base and ultimately help in shoring up our reserves.

“While the dynamics of global trade continues to evolve in advanced economies, Nigeria remains committed to a free trade regime that is mutually beneficial but particularly aimed at supporting our domestic industries and creating jobs on a mass scale for Nigerians.

“We intend to aggressively implement our N500bn facility aimed at supporting the growth of our non-oil exports, which will help to improve non-oil export earnings.”

He said the CBN would launch a Trade Monitoring System in October this year which is an automated system that would reduce the length of time required to process export documents from one week to one day.

Financial system stability

On financial system stability, the apex bank boss said the CBN would continue to improve its onsite and off-site supervision of all financial institutions, while leveraging data analytics and in-house experts across different sectors, to improve its ability to identify potential risks to the financial system as well as risks to individual banks.

Development finance

Emefiele said in keeping with the recent Presidential Directives, he intended to boost productivity growth through the provision of improved seedlings, as well as access to finance for rural farmers in the agricultural sector, across 10 different commodities namely rice, maize, cassava, cocoa, tomato, cotton, oil-palm, poultry, fish, and livestock/dairy.

“We believe these measures will help to boost not only our domestic outputs but also improve our annual non-oil exports receipts from $2bn in 2018 to $12bn by 2023,” he added.

Financial inclusion

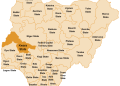

In the area of financial inclusion, Emefiele said over the next five years, through initiatives and policy measures such as the Shared Agent Network and the payment service banks, he intended to broaden access to financial services to individuals in underserved parts of the country. – Punch.