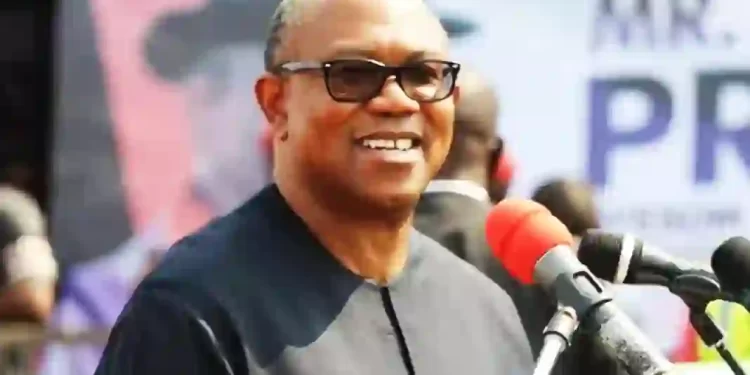

The 2023 Labour Party presidential candidate, Peter Obi, has said there is nothing wrong with pursuing the tax reform.

The bills, which have passed second reading in the Senate, include the Joint Revenue Board of Nigeria (Establishment) Bill, 2024-SB.583; the Nigeria Revenue Service (Establishment) Bill, 2024-SB.584; the Nigeria Tax Administration Bill, 2024-SB.585; and the Nigeria Tax Bill, 2024-SB.586.

However, the bills have been the subject of heated debate in recent weeks, with critics accusing the government of targeting specific regions, particularly the North, and jeopardising the funding of important government initiatives.

Obi, in a statement shared on X (formerly Twitter), said that tax reform is critical but must be approached in a way that prioritises public trust and considers the broader impact on the nation.

“Tax reform is a critical issue, and there is nothing wrong with pursuing it. However, such reform must be subject to robust and informed public debate. A public hearing on tax reform is essential, allowing Nigerians from all walks of life to engage meaningfully. This is how we build public trust and ensure inclusivity in policymaking,” Obi said.

He noted that matters of this magnitude require extensive deliberation and careful consideration and should never be rushed.

Obi urged that public hearings must be conducted to allow for diverse opinions and inputs.

According to him, such a public hearing would enable the broadest spectrum of public opinion to be reflected in public policy.

Obi also pointed out that when considering tax reforms and similar issues, it is insufficient to focus solely on the benefits to the government, particularly in terms of increasing revenue collection.

“We must also take into account the overall impact on the nation and the sustainability of all its regions. Furthermore, the government must sensitise the people and secure their buy-in for any policy changes,” he said.